Grasping a business’s value is instrumental not only for those directly involved in its day-to-day operations but also for potential investors, strategists, and other stakeholders. Business valuation encompasses a multifaceted set of calculations and judgment calls to arrive at a solid appraisal of a company’s worth. An accurate valuation is crucial for business processes such as mergers and acquisitions, securing funding, or determining share prices for public offerings. It serves as the financial foundation upon which many strategic decisions are made. Leading entities in financial assessment stress the imperative of embedding thorough and nuanced evaluation mechanisms within a company’s financial practices to bolster data-driven decision-making.

Key Takeaways

- They are gaining insight into various valuation techniques and their applicability to different business scenarios.

- Understanding the profound impact of various factors, including external economic and industry trends, on business valuations.

- Emphasizing the value of retaining seasoned experts to navigate the complexities of accurate business appraisals.

- Illustrating through case studies how practical applications of these concepts can shape business strategies and decisions.

Table of Contents

- Overview of Common Business Valuation Methods

- Why Business Valuation Matters

- The Process of Business Valuation

- Valuation for Different Business Stages

- Decoding Financial Statements for Valuation

- The Role of Intangible Assets in Valuation

- External Market Factors Affecting Business Valuation

- Choosing a Valuation Professional

- Case Studies: Real-world Examples of Business Valuation

Overview of Common Business Valuation Methods

The methods of business valuation are as varied as they are complex. One can take an asset-based approach, which essentially sees a business as a sum of its parts—assets and liabilities. This approach can be particularly insightful for companies that are property or equipment-heavy. In contrast, the earnings value method relies on understanding a business’s capacity for wealth generation, capitalizing its future profitability to derive present value—an approach fitting for firms whose value lies more in their operations than their physical assets. Here, healthcare valuation firms play a crucial role, employing specialized methods to account for factors like regulatory environment, intellectual property, and patient base. Yet another avenue is the market value approach, which aligns a business’s value with comparable companies within the same industry. This last method provides a relative measure of value, highlighting how the free market views the worth of similar entities.

Why Business Valuation Matters

The importance of business valuation cannot be overstated; it has a far-reaching impact beyond mere numbers on a financial statement. A solid valuation report can spell the difference between a wise investment and a miscalculated venture for investors. The figures from the valuation process carry significant legal weight in dispute resolution matters, whether in partnerships, contract negotiations, or divorce proceedings where a business’s value must be equitably divided. On the tax front, authorities utilize valuations to determine appropriate tax liabilities linked to asset transfers, ownership changes, or estate settlements. Furthermore, the insights derived from valuation foster strategic business planning, providing company leaders with the analytics needed to optimize operations, pursue growth opportunities, or prepare for potential market downturns. Given these crucial functions, valuating a business guides its strategic trajectory, hypostasizing its value into actionable intelligence.

The Process of Business Valuation

The rigorous valuation process involves examining a company’s historical performance, present circumstances, and prospective future outcomes. It begins with collecting and analyzing copious amounts of financial data, industry statistics, and market forecasts. Equipped with a detailed financial understanding, evaluators select the most fitting valuation method to articulate the business’s value best. Throughout this meticulous process, adjustments are made to contend with distinct attributes of the business—such as market share, customer base, and operational efficiency—that might otherwise skew a valuation. Specific methods might inflate or deflate a figure based on these characteristics, and it’s up to the seasoned professional to navigate these nuances. As the process unfolds, the interpreter of this financial narrative must deftly consider every economic, industry-specific, and organizational detail that could influence the valuation outcome.

Valuation for Different Business Stages

Age and maturity are pivotal considerations in business valuation. With their unproven models and potential for disruption, startups are often challenging to value, given their relative lack of tangible assets and established financial histories. Here, investors might lean on the perceived potential of the business model, the founders’ pedigree, or the product’s traction in the market. In contrast, with their historical financial data, established market positions, and more apparent trajectories, established businesses allow for a more traditional application of valuation methods. This stage-based approach to valuation is pivotal in providing context-appropriate assessments that reflect the unique risks and opportunities businesses present at distinct lifecycle stages.

Decoding Financial Statements for Valuation

To the seasoned eye, financial statements are rich tapestries from which the story of a company’s value can be decoded. The accuracy and integrity of these documents are the bedrock upon which any valuation is built. Analysts scrupulously pore over balance sheets to discern the health of assets and liabilities; income statements are dissected to reveal profitability trends; and cash flow statements are examined to understand the liquidity and operability of the business over time. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), net income, and revenue growth rates are key indicators in painting the business’s financial standing. These figures serve as the compass points guiding the valuation expert through the often turbulent seas of financial analysis.

The Role of Intangible Assets in Valuation

In this modern economy, where service-based industries and technology reign supreme, the role of intangible assets in valuation has become increasingly paramount. These assets—from powerful brand identities and intellectual property to extensive customer bases and proprietary technologies—can represent a significant portion of a business’s overall value. Unlike physical assets, whose values can often be quantified with relative ease, the valuation of intangibles is nuanced. It requires a deep understanding of the business’s unique market position, innovative capacity, and customer relationships. The challenge is significant, yet so is the potential for intangibles to sway the final valuation numbers positively or negatively. This emerging facet of the valuation field commands both reverence and a robust approach to capture the true essence of a business’s worth conscientiously.

External Market Factors Affecting Business Valuation

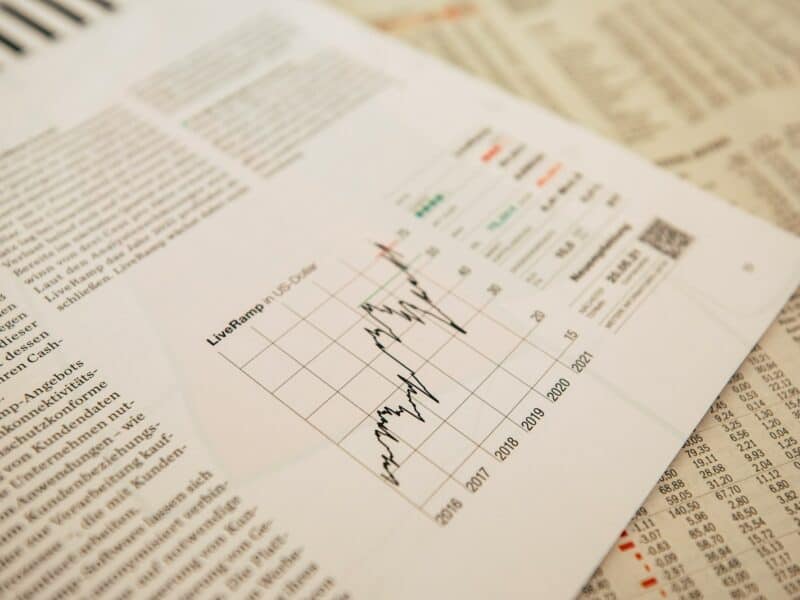

No business operates in isolation—external market factors significantly influence a company’s valuation. Macroeconomic variables such as inflation rates, interest rates, and GDP growth directly affect business performance and, by extension, their perceived value. Changes in technology, shifts in consumer preferences, and evolving regulatory landscapes must also be accounted for, as these can dramatically impact current operations and prospects. A thorough valuation analysis will factor in these elements, offering a forward-looking perspective that counters any myopic tendencies that could hinder the accuracy of the valuation.

Choosing a Valuation Professional

Identifying the right expert for business valuation is akin to finding a captain adept at piloting through familiar waters and confidently steering the ship through uncharted seas. A balance of industry experience would distinguish a professional, recognized credential (such as ASA or CFA) and an extensive track record of successful valuations. Furthermore, the ideal expert would deeply understand the company’s operating market, stay informed on the latest financial trends, and possess the agility to adapt methodologies as the economic landscape evolves. Entrusting a business’s valuation to such a professional ensures the precision of the numbers derived and the nuanced interpretation of those figures in the context of broader financial and strategic planning.

Case Studies: Real-world Examples of Business Valuation

The real-world applications of business valuation encapsulate the theory and bring it to life. Through case studies, one can observe businesses’ unique journeys during their valuation processes, gaining insight into the diverse strategies employed based on industry, size, or market positioning. These practical examples provide lessons on the significance of a thorough evaluation process and the strategies that can be developed from insightful valuations. Above all, case studies highlight the adaptability of valuation practices as they must morph and expand in response to the dynamic nature of global finance and business—always in flux, always presenting new challenges and opportunities for the savvy business professional to navigate.